Shaping the future of global payments.

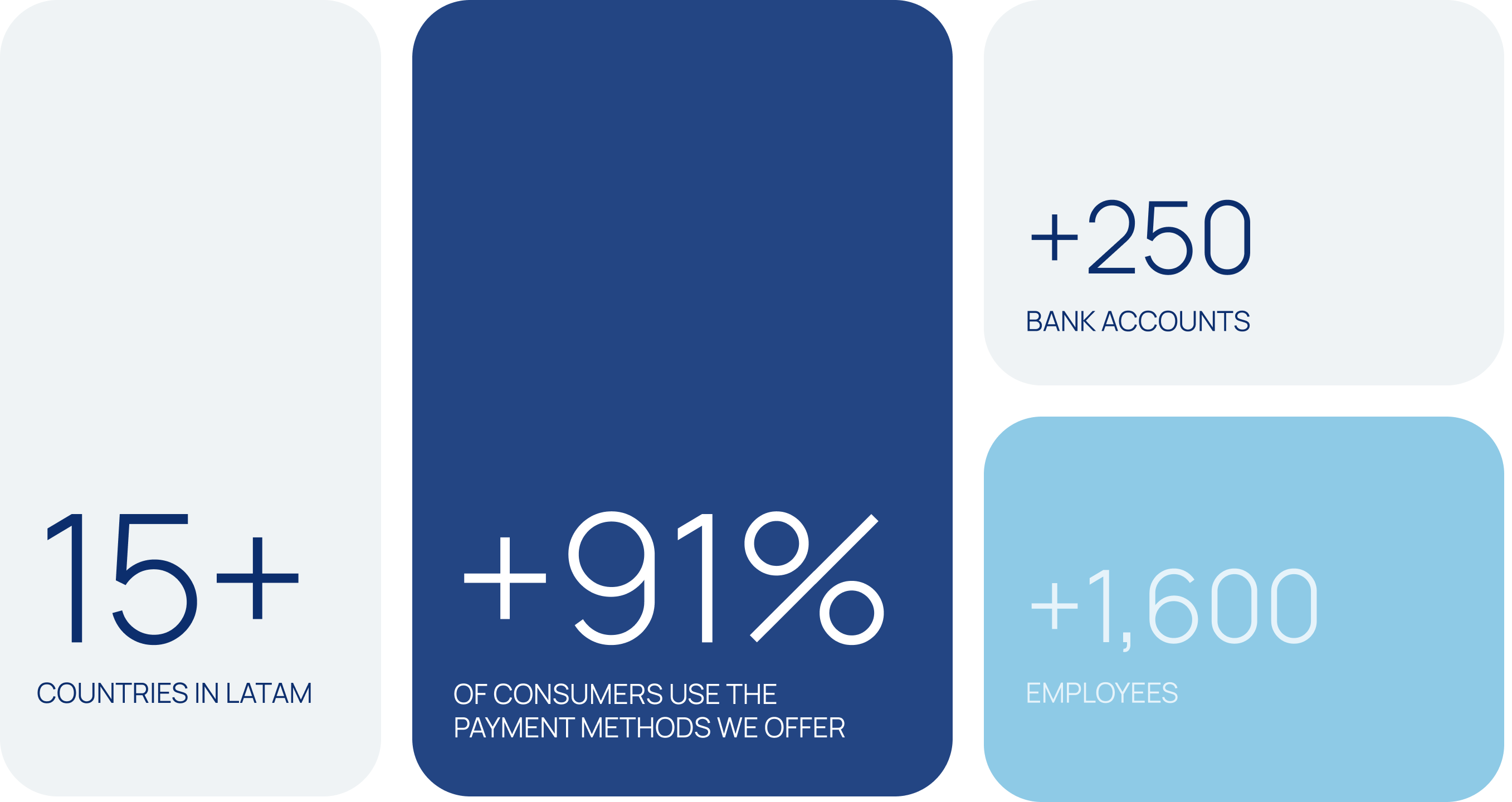

Localpayment is part of Aleph Group, and jointly they process billions in payments annually, offering extensive bank coverage and industry-leading success rates, creating a trusted network that scales businesses both locally and globally.